Investment Strategy

We seek partnerships where our robust in-house portfolio support capabilities can truly add value for management teams. We invest in exceptional companies in growing markets that exhibit key quantitative and qualitative characteristics that enable strong and predictable returns via revenue acceleration strategies.

We invest in companies with sustainable growth across three main areas of focus – Life Sciences & Healthcare, Software & Technology, and Business & Consumer Services and Products.

We target investments between $50 and $500 million in enterprise value.

TSCP enables proven management teams to realize the maximum potential of their businesses, whether founder-led companies, family businesses in transition, or management-driven organizations.

TSCP has the flexibility and creativity to execute accretive recapitalizations, buyouts, corporate divestitures, and take-privates.

We invest in asset-light companies with high margins, predictable revenues, and leading positions in niche markets.

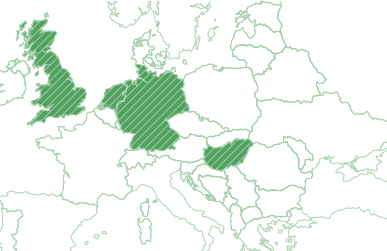

Global Experience

We seek great businesses across the world, and have successfully partnered with companies in North America, Europe, and Australia. Our global reach enables us to support businesses and management teams wherever they may be located and accelerate their growth through geographic expansion.